What Does Paul B Insurance Mean?

Table of ContentsRumored Buzz on Paul B InsuranceThe Facts About Paul B Insurance RevealedThe 4-Minute Rule for Paul B InsuranceThe Single Strategy To Use For Paul B Insurance

If there is healthcare you anticipate to need in the future that you have not required in the past (e. g., you're expecting your first child), you might have the ability to get an idea of the possible expenses by consulting your current insurance provider's price estimator. Insurance companies often produce these types of tools to assist their members buy healthcare.Equipped with information concerning present and future clinical needs, you'll be far better able to evaluate your strategy choices by using your estimated prices to the plans you are considering. All the health and wellness insurance intends talked about over include a network of medical professionals and health centers, but the dimension and range of those networks can differ, even for strategies of the same type.

That's due to the fact that the medical insurance company has a contract for reduced rates with those particular service providers. As gone over formerly, some plans will permit you to use out-of-network companies, yet it will cost you much more out of your very own pocket. Various other plans will not cover any type of treatment received outside of the network.

It might be an integral part of your choice. Below's a recap of the tips supplied over: See if you're qualified for an aid, so you can establish what your premiums will be and so you'll understand where you require to go shopping. Testimonial your existing strategy to understand how it does or does not meet your needs, as well as keep this in mind as you examine your choices.

Paul B Insurance Things To Know Before You Buy

Get insurance claims as well as therapy expense information from your current insurance firm's participant site to understand past and also possible future clinical costs. Use this information to estimate out-of-pocket prices for the other plans you're taking into consideration. Research the networks for the plans you are taking into consideration to see if your favored physicians and hospitals are consisted of.

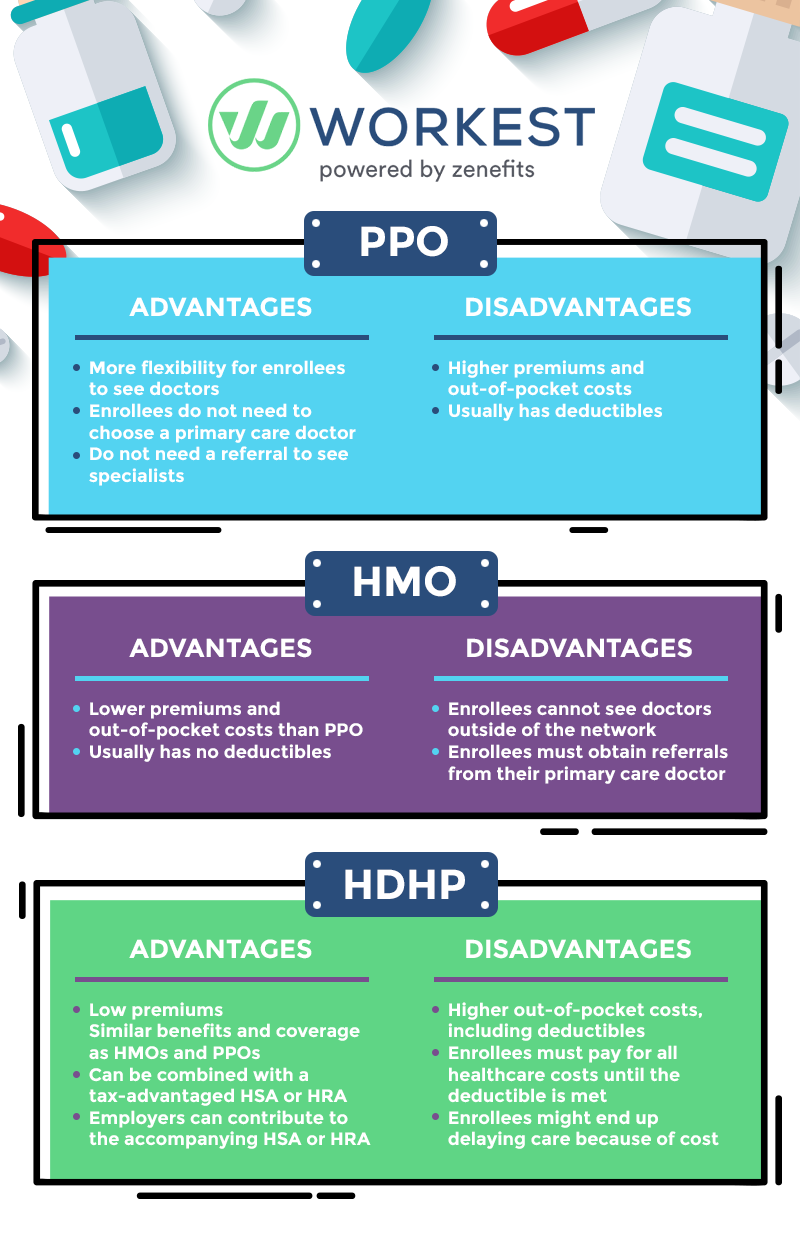

An FFS choice that allows you to see clinical carriers that decrease their costs to the strategy; you pay less cash out-of-pocket when you use a PPO provider. When you see a PPO you normally won't need to file insurance claims or paperwork. Going to a PPO medical facility does not assure PPO benefits for all solutions received within that healthcare facility.

Most networks are rather wide, however they might not have all the physicians or health centers you want. This strategy typically will conserve you cash. Typically signing up in a FFS plan does not ensure that a PPO will certainly be available in your area. PPOs have a more powerful visibility in some regions than others, as well as in locations where there are regional PPOs, the non-PPO benefit is the common benefit.

Your PCP gives your basic medical care. In numerous HMOs, you need to obtain authorization or a "referral" from your PCP to see other suppliers. The recommendation is a suggestion by your medical professional for you to be reviewed and/or treated by a different physician or physician. The referral makes sure that you see the right provider for the treatment most suitable to your condition.

The 9-Minute Rule for Paul B Insurance

A Wellness Interest-bearing accounts permits people to pay for existing health and wellness expenditures as well as save for future certified medical expenses on a pretax basis. Funds transferred right into an HSA are not tired, the balance in the HSA expands tax-free, and that amount is offered on a tax-free basis to pay medical expenses.

HSAs are subject to a variety of rules and also constraints developed by the Division of Treasury. Check out Department of Treasury Resource Center for even more information.

They get to know you and your health requirements and can assist work with all your treatment. If you need to see an expert, you are needed to obtain a reference.

How Paul B Insurance can Save You Time, Stress, and Money.

If you presently have health and wellness insurance policy have a peek at this website from Friday Health Plans, your protection will certainly end on August 31, 2023. To stay covered for the remainder of 2023, you need to enroll in a new strategy. Start

Staff members have an annual insurance deductible they should fulfill before the wellness insurance business starts covering their medical costs. They may likewise have a copayment for certain services or a co-insurance where they are accountable for a percentage of the overall charges. Solutions beyond the network generally lead to greater out-of-pocket costs.